- Rhoda Report

- Posts

- Life is Good in the Markets Right Now!

Life is Good in the Markets Right Now!

Issue #13

Hi There! I am not much of an American Football fan, but I couldn't pass up this opportunity to mention the final score (31 - 7) in the Eagles vs 49ers game. Without a shadow of a doubt, the Eagles soar into Super Bowl LVII on Sunday, February 12, 2023. Fly Eagles! Fly!

Let's dig in!

The U.S. Stock Market ended in the green last week. The Nasdaq enjoyed the biggest gain at 1.2%, while S&P 500 and the DOW gained 0.6% and 0.3%, respectively. U.S. gold futures remained at $1,930.20, with gold looking to rise ahead of the Fed rate decision in the week ahead. Can the gold bulls tag $2,000.00? Crude Oil struggled after a bullish start last week. The personal consumption expenditures (PCE) Price Index was lower than expected and Core PCE (excluding food and energy), which is the preferred inflation measure by the Fed, met expectations.

Bitcoin (BTC) has been having its best start so far this year. BTC price jumped almost 40% this month amid weakness in the U.S. Dollar. Analysts report that 85% of this bull run has been powered mainly by U.S.-based buyers. Will Ethereum (ETH) and Polygon (MATIC) catch up soon?

Other key highlights from last week:

Justin Sun Sets KPI For 2023 To Have 5 Countries Adopt Tron (TRX)

White House Blames Congress for Failure to Enact Crypto Regulations

Amazon partners with Ava Labs (Avalanche blockchain) to launch NFTs

Polygon soars 8% ahead of zkEVM Network Update

Another action-packed week ahead. Here's what to expect:

Japan Unemployment Rate (JPY) and Germany GDP Growth Rate (EUR) releases will kick off the week on Monday (1/30/2023). Chinese markets return after the Lunar New Year holidays and will look to pick up where they left off, starting with the Chinese PMI data to be released on Tuesday (1/31/2023). The latter part of the week will be the main focus - Bank of England (BoE) and European Central Bank (ECB) Interest Rate Decisions. Both are expected to hike interest rates by 50 bps. ECB President Lagarde will most likely remain hawkish.

Back in the U.S.:

All eyes will be on the Fed Interest Rate Decision (on Wednesday 01/01/2023), which is expected to be raised by 25 bps. Pay close attention to Fed Chair Jerome Powell's post-policy press conference for any indication as to when the Feds may consider a halt in rates (if at all). The week will also be packed with earnings. The big ones are - META Platforms (NASDAQ: META), Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN), and Alphabet (NASDAQ: GOOGL). Southwest Airlines (NYSE: LUV) is also in the mix. Let's see what happens after that Southwest debacle.

Next week's anticipated bias (not financial or investment advice):

Monday (01/30/23) - End of month profit taking

Tuesday (01/31/23) - Bearish

Wednesday (02/01/23) - Expect the unexpected; Trade after FOMC

Thursday (02/02/23) - Enter the markets late morning

Friday (02/03/23) - Pay yourself Friday; Take profits

Trading Tip: When all timeframes align, it's a go!

January Week 01/22/23 - 01/28/23 Recap

Special Tools & Strategy for the Week

Here is a useful TradingView tool for you - the Day Trading Booster by DGT.

This indicator is designed to:

assist in determining market peak times, the times when better trading opportunities may arise

assist in determining the probable trading opportunities

help traders create their strategies

An example strategy of when to trade or no is presented below.

Forex markets specifically include:

Opening Channel of the Asian Session, European session or both

Opening price, opening range (5m or 15m), and day (session) range of the major trading center sessions, including Frankfurt

A tabular view of the major forex markets' opening/closing hours, with a countdown timer

Schedule a Call- Let's chat!

Wanna thank me...Buy me a coffee!

Sign up for our Secret 10-Page Trading Plan!

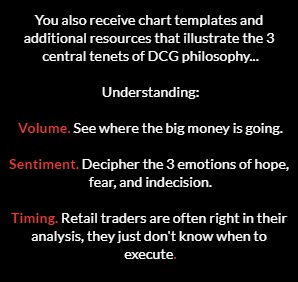

Join the DCG Elite Mastermind!

Disclaimer: This newsletter is strictly educational. The information provided in this report does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the report’s content as such. Please be careful and do your own research.