- Rhoda Report

- Posts

- "Move Out The Way!"

"Move Out The Way!"

Issue #25

Hi There! It's time to break out the confetti and a shot of Grenada's pure white rum because we have much to celebrate! Drumroll, please... the Rhoda Report has hit its silver issue! That's right, we've made it to the big 2-5, and I couldn't have done it without you.

Okay, let's dig in!

The markets ended last week with a narrow loss. The S&P 500 slipped 0.1%, the Dow dipped 0.2%, and the Nasdaq lost 0.4%. This left investors anxious and uncertain. Despite their best efforts to decipher the Fed's next move, many are speculating that another interest rate hike is likely. Unless a significant catalyst is announced that will drive the market in either direction, the consolidation is expected to persist. Preserve your capital!

Last week, the crude oil market was all over the place! It initially went up due to OPEC+'s output cut, but quickly lost steam and failed to break through the 200-Day EMA (around a key level at $83.04). As a result, the price dropped leaving that huge April 2nd gap half filled. By the end of the week, the oil markets ended on a positive note, as the price bounced off the 50-Day EMA. Still, traders remain worried about demand for the upcoming summer driving season, which is affecting market sentiment. Continue to trade defensively and set tight stops for oil.

Meanwhile, Bitcoin (BTC) closed out last week with a nice push off the 50-Day EMA ($27,200). If the price opens above $28,550 it is expected to rally to $30,000 and possibly go to $34,500. Maybe hype! Maybe not! Trade what you see!

Other key highlights from last week:

Jamaican government to incentivize JAM-DEX CBDC merchants

Top AI dataset depends on multiple crypto platforms for data

Aliyah A. Boston and Bozoma Saint John are among the 45+ speakers at VeeCon 2023

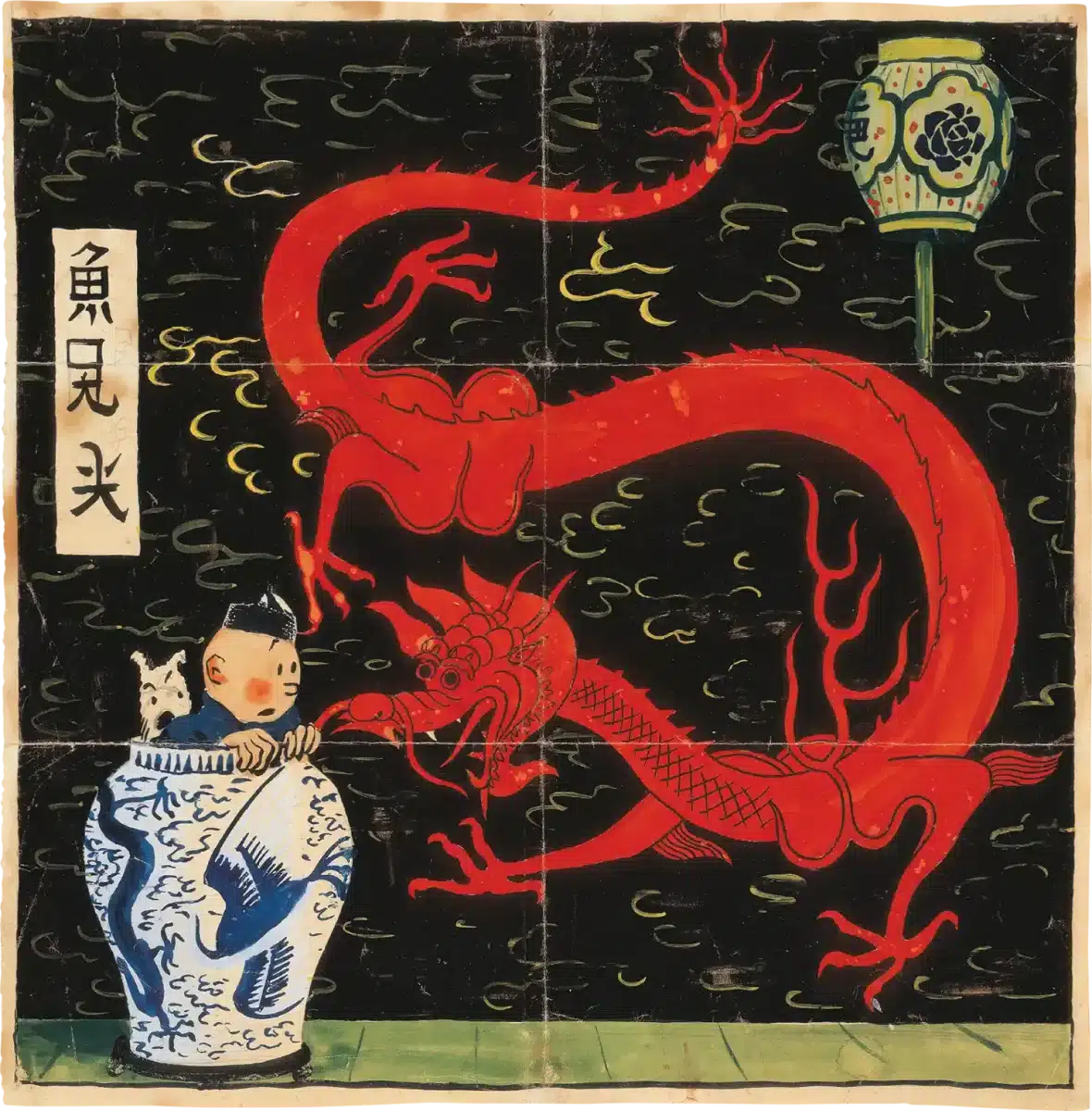

The beloved Tintin comic series gets its first-ever NFT collection.

The week ahead is highly, news-driven:

The following U.S. economic reports will be the center of focus: The Conference Board (CB) Consumer Confidence, New and Pending Home Sales, Durable Goods Orders, GDP Growth Rate, Initial Jobless Claims, Core Personal Consumption Expenditure (PCE) Price Index, Employment Cost Index, Personal Income and Spending, and Final Michigan Consumer Sentiment Report.

This week's upcoming earnings releases are shown in the chart below. The mega-cap earnings are Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOG), Meta (NASDAQ: META), Boeing (NYSE: BA), Amazon (AMZN), and Exxon Mobil (NYSE: XOM).

The upcoming high-impact global news includes the Ifo Business Climate, Gfk Consumer Confidence, Unemployment, GDP Growth Rate, and Inflation Rate for Germany; Australia's Inflation and Unemployment Rates; Bank of Japan (BoJ) Interest Rate Decision and Japan's Unemployment Rate and Retail Sales; and, Canada's GDP Release.

The Euro Area Economic and Financial Affairs Council (ECOFIN) Meetings will be held on Saturday (4/29/2023) in Brussels. These meetings are attended by Finance Ministers from European Union (EU) member states. They discuss a range of financial issues, such as euro support mechanisms and government finances. The meetings are closed to the press but officials usually talk with reporters throughout the day, and a formal statement covering meeting objectives may be released after the meetings have concluded. Investors will be listening for news that can have a widespread effect on the Euro Area's economic health. Stay tuned!

Next week's anticipated bias (not financial or investment advice):

Monday (04/24/23) - Last Monday of the month; expect positioning

Tuesday (04/25/23) - Historically a down day

Wednesday (04/26/23) - Look for afternoon setups

Thursday (04/27/23) - Expect profit-taking

Friday (04/28/23) - Bearish

Trading Tip: The market is bullish if a new high occurs with heavy volume!

Week 04/16/23 - 04/22/23 Recap

Special Tools and Strategies

If you are looking for a good research tool to make smart, money-making investments or trades, check out the WeWave app.

WeWave is a fast-growing investing platform that makes it simple to watch, analyze, and interpret data on multiple asset classes: Stocks, Exchange-Traded Funds (ETFs) Cryptocurrencies, and Forex. You can easily keep track of your favourite stocks using personalized charts and graphs. Additionally, you can stay ahead of the market by accessing detailed insider reports and advanced analytics modules exclusively available on the app.

Here are some key features:

WeWave has a drawing tool that allows you to search and match technical patterns for any ticker against the entire US stock market and all cryptocurrencies.

WeWave allows you to monitor where money flows by tracking metrics like retail sentiment, buy/sell flow, and trends. The app's AI-powered Unusual Activity module can help you identify anomalies in price action that could affect your trades.

WeWave also offers advanced analysis of fundamentals and technicals, as well as insights from social media mentions and Wall Street for over 10,000 tickers.

Schedule a Call- Let's talk!

Wanna thank me...Buy me a coffee!

Sign up for our Monthly Trading Plan!

Join the DCG Elite Mastermind!

Disclaimer: This newsletter is strictly educational. The information provided in this report does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the report’s content as such. Please be careful and do your own research.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/KNPVWD5BWVKVTKJGY7FDZEAQ4E.jpg)