- Rhoda Report

- Posts

- "Both o' dem!"

"Both o' dem!"

Issue #38

Hi There! The transition from the serene, laid-back pace of the island to the frantic, non-stop rush of the U.S. has been quite a challenge for me. Despite spending 25 years here, I'm still not accustomed to the fast-paced lifestyle. Take me back to the calmness...lol! I find myself struggling to find my rhythm, and I realize that preserving my peace is of utmost importance. I'll need to do some rescheduling to ease back into the swing of things without disrupting my inner Zen. Needless to say, it may take me another week or maybe two to adjust fully. I am in no rush. My peace is my priority, and I won't compromise it for anything.

Grand Anse Beach 2023. Photo by Rhoda Hall

Okay, let’s dig in!

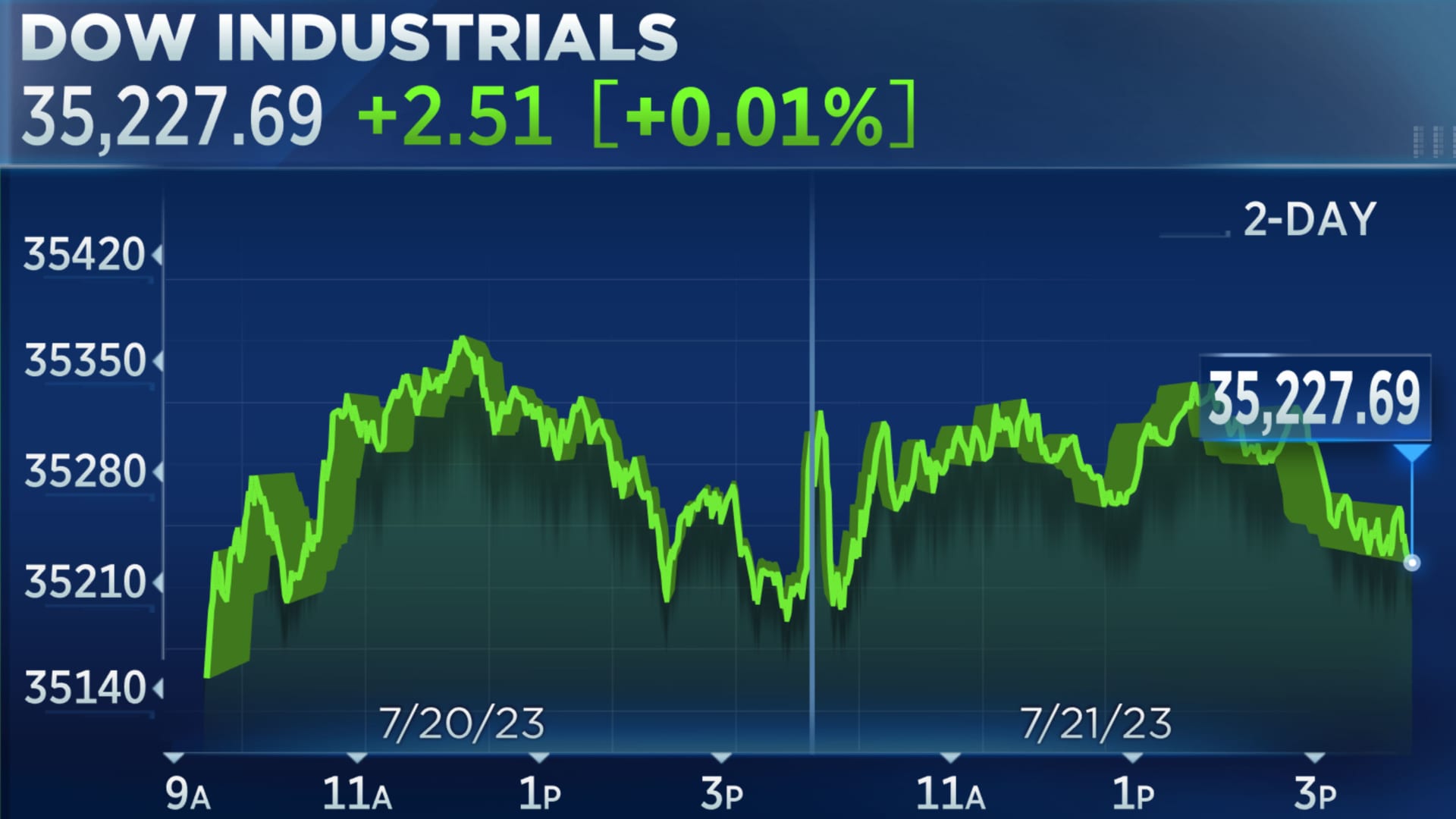

Despite ongoing economic concerns, investors are showing resilience and cautious optimism as they navigate the earnings season. The majority of companies reporting earnings have been pleasantly surprised by beating expectations, driving some bullish momentum in the markets. Though the end of last week saw mixed results with the Dow celebrating its 10th consecutive winning last Friday, and the S&P 500 and Dow gaining ground for the second week in a row, the Nasdaq experienced a slight dip due to upcoming index changes. While economic data continues to point to a weakening economy, investors remain watchful and measured in their approach to the markets during these uncertain times.

Here are other key highlights from last week:

Oil rallied for a fourth straight week on tightening supply

Bitcoin price is down

You can now trade NFT for NFT on OpenSea

Cardano NFTs – A Sleeping Giant

10 real-world examples of blockchain use in the public sector

This week is a busy one in the markets:

As investors navigate the current economic landscape, it is very important not to overlook the negative economic data that continues to surface. Recent indicators, such as the Index of leading economic indicators and the Philly Fed manufacturing survey, both signal the forever lingering possibility of a recession. With this in mind, all eyes are now focused on the Federal Reserve, as expectations mount for a 25 basis points increase in interest rates on tomorrow (Wednesday, July 26). This potential move would take the base rate to its highest level in nearly two decades, and there's a possibility that further adjustments may follow. Additional insights will be unveiled when the Fed's policy statement is released on Wednesday, followed by the release of U.S. Gross Domestic Product (GDP) and Durable Goods Reports on Thursday, and the Personal Consumption Expenditure (PCE) price index on Friday.

Overseas economic data highlights:

Weak reports from Asia and Eurozone at the week's start.

Focus shifts to the ECB possibly ending the rate hike cycle on Thursday.

BoJ Meeting on Friday is expected to maintain the current policy.

This week's earnings began with big players like Microsoft Corporation (NASDAQ: MSFT) and Alphabet Inc. (NASDAQ: GOOGL). Be on the lookout for Meta Platforms, Inc. (NASDAQ: META) tomorrow and other companies throughout the remainder of the week.

This week's anticipated bias (not financial or investment advice):

Monday (07/24/23) - Wild swings in the stock market

Tuesday (07/25/23) - Neutral - Be cautious

Wednesday (07/26/23) - All markets should run if Fed Rate is as expected

Thursday (07/27/23) - Take advantage of the trading opportunities

Friday (07/28/23) - Dip Buy

Trading Tip: In an extremely bullish market sentiment, don’t sell….Buy!

Week 07/17/23 - 07/21/23 Recap

Special Tools and Strategies

NWOG/NDOG:

The New Week Opening Gap (NWOG) is the difference between Friday's closing price and Sunday's opening price.

The New Day Opening Gap (NDOG) refers to the difference between the 5 pm EST Close Price and the 6 pm EST Open Price.

These gaps can serve as liquidity markers or general reference points to gauge the market's direction.

This is how we use the NWOG/NDOG indicator:

Use them as potential support or resistance areas.

In consolidating market conditions, prices tend to revert towards the opening gap area, a trend consistent with other analyses.

For entry:

open a short position if the price opens below the gap

open a long position if it opens above the gap

Set a stop loss if the price pulls back into the box

This indicator can provide 1-3 high probable setups each week with significant moves. Set a minimum break-even stop loss.

To add to your TradingView Chart, search for Weekly Opening Gap and select the one by Cryptonnnite.

Source: TradingView

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your own research.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/X2VGJ2IHUNLX5EHR4VBVST4JWY.jpg)