- Rhoda Report

- Posts

- "Where the Party At?"

"Where the Party At?"

Issue #41

Hi There! As I write this week's report, I can't help but think of the masqueraders adorned in their pretty costumes taking a last lap, chipping in the street to Dash's "Greater" or Terror D Governor's "Zen Mode", to close Grenada's Carnival, Spice Mas!

This explosive celebration takes over August's second weekend, following a crescendo of festivities from July. It's a whirlwind of music, colour, and sheer freedom. Spice Mas is a true testament to Grenadian culture, where participants invest boundless time and effort into crafting stunning attire that steals the spotlight. Imagine vibrant costumes, the national Queen show, Calypso Monarch, Panorama steel band showdowns, and the high-energy Groovy and Power Soca Monarch competitions (listed in no particular order).

But the pinnacle is J'ouvert – as darkness meets dawn, the streets come alive with an explosion of sound, the smell of ole oil, and mobs of black - Jab Jab! Bodies of all ages- adorned in black oil, paint, or powder, sweep through the streets pulsating to the hypnotic rhythms of sweet Soca music and the spirited beat of the island's soul. Spice Mas paints Grenada in unforgettable, vibrant strokes.

Jab Jab. Photo Credit: Arthur Daniel

Alright, let’s dig in!

Last week, the markets experienced some ups and downs due to uncertain inflation readings. Despite the fluctuations, stocks found a bit of upward momentum following a positive inflation report, indicating a potential return to more normal price growth levels. The S&P 500 and Nasdaq saw minor declines of around 0.3% and 1.9% respectively, while the Dow Jones Industrial Average managed to finish the week on a positive note, gaining 0.6% or over 100 points. Additionally, Disney investors responded positively to the company's plans to adjust pricing for its streaming services and address password sharing, reminiscent of Netflix's approach.

Bitcoin's price has been hovering between $28,000 and $30,000, suggesting a stagnant phase could be indicative of network health. The market may be waiting for a catalyst to trigger future price movements.

OPEC's monthly report indicates revised global GDP growth for 2023 and 2024, with oil demand expected to increase in the coming quarters. However, OPEC's 2024 demand estimates were lowered, potentially leading to a supply shortfall. Record U.S. production offsets lower OPEC production. The International Energy Agency warns of inventory drawdowns due to high global oil demand. Crude oil prices pulled back after trading above $87, with resistance observed at $90 and potential support levels at $82.50 and $77.40 for Brent and WTI crude oil, respectively. The long-term outlook for inflation will be driven by oil prices which have support in the $80 range.

Here are other key highlights from last week:

PayPal launched dollar-backed stablecoin, boosting shares

Web3 gaming & metaverse attract $297M

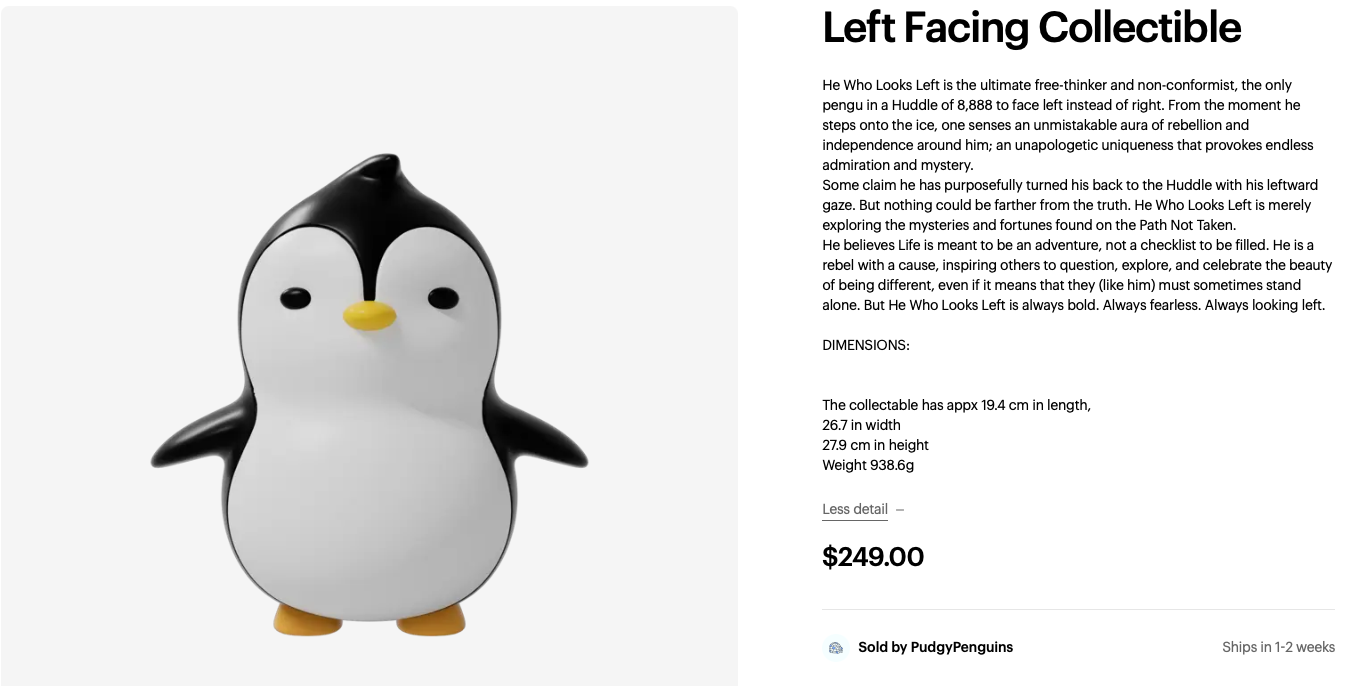

Pudgy Penguins takes flight with a fresh line of toys

Polygon Miden’s public testnet will launch in Q4 2023

This week is a less busy one in the markets:

In the U.S., it's a relatively quiet news week, but the markets began on a strong note on Monday. However, the S&P 500 faced a minor setback on Tuesday due to signs of robust consumer spending, sparking concerns about potential Federal Reserve rate hikes later this year. Retail sales surprised with a 0.7% increase last month, surpassing the anticipated 0.4% and marking the biggest rise since January. As we approach August 16, 2023, attention turns to the forthcoming July FOMC meeting minutes. Additionally, Thursday brings the usual weekly Jobless Claims Report and the Philly Fed Manufacturing Index, ensuring this understated week still holds key insights.

Global events this week include:

RBNZ meeting: Rates likely to stay unchanged, NZD impact minimal

UK July CPI: possible effects on rate hike expectations.

Australia July employment: Expected 15k job increase, won't sway rate outlook.

Japan July CPI: Keep an eye on 3.3% for headline CPI and 4.3% for core CPI.

Although earnings season is slowing down, there are still many large companies yet to report. Look out for $TGT, $TJX, $CSCO, $JD, and $TCEHY tomorrow; $WMT, $ROST, and $AMAT on Thursday; and $DE, $PANW, and $XPV on Friday.

This week's anticipated bias (not financial or investment advice):

Monday (08/14/23) - Protect all positions in crypto and stock markets

Tuesday (08/15/23) - Bullish

Wednesday (08/16/23) - Expect high volatility; trade after 12p CST

Thursday (08/17/23) - Take profits or set stops

Friday (08/18/23) - Expect selling during the early NY session

Trading Tip: Thursday, August 17th, 2023 is a day to exit or take profits!

Week 08/06/23 - 08/12/23 Recap

Special Tools and Strategies

Buy the Bitcoin Dip

Bitcoin's performance in 2023 has been a remarkable turnaround from its decline in 2022. Starting at $16,000 on January 1st, it surged by approximately 63% to reach $27,152. In June, it even crossed the $30,000 mark, driven by hopes that the Fed's rate hikes were ending and inflation was stabilizing.

Markets can be highly unpredictable, prompting the use of strategies like dollar-cost averaging to manage volatility. This method involves dividing your investment into regular purchases of the target asset, regardless of market trends, such as investing the same dollar amount monthly or quarterly.

The idea behind this strategy is that when prices are high, you acquire fewer shares, but more when prices are low. This positions you to benefit from purchasing more shares at lower prices when the market bounces back. However, it's important to note that this approach doesn't guarantee profits or provide immunity against market declines (not investment advice).

If you ever find yourself with some spare time on a Sunday evening into early Monday morning, you might consider purchasing Bitcoin, as it's often considered an opportune time based on historical patterns shown in the table below.

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/FRTSOBTMLJPH5OGFTZ36JDVXI4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VLAYHADODZLMPPDR72BOUILFKQ.jpg)