- Rhoda Report

- Posts

- "And it Teeters and it Totters!"

"And it Teeters and it Totters!"

Issue #50

Hi There! I was honoured to be invited as one of the keynote speakers at the inaugural Women's Empowerment event in Grenada. Sharing my journey with women of all ages was nothing short of amazing. How fitting that this event fell on the 3-year anniversary of my departure from the engineering field to follow my passion, educating women about investing, trading, and holistic wellness - mind, body, spirit. As I stood before the inspiring women of Grenada, I couldn't help but think that the best is yet to come.

Photo: Rhoda Hall

Alright, let’s dig in!

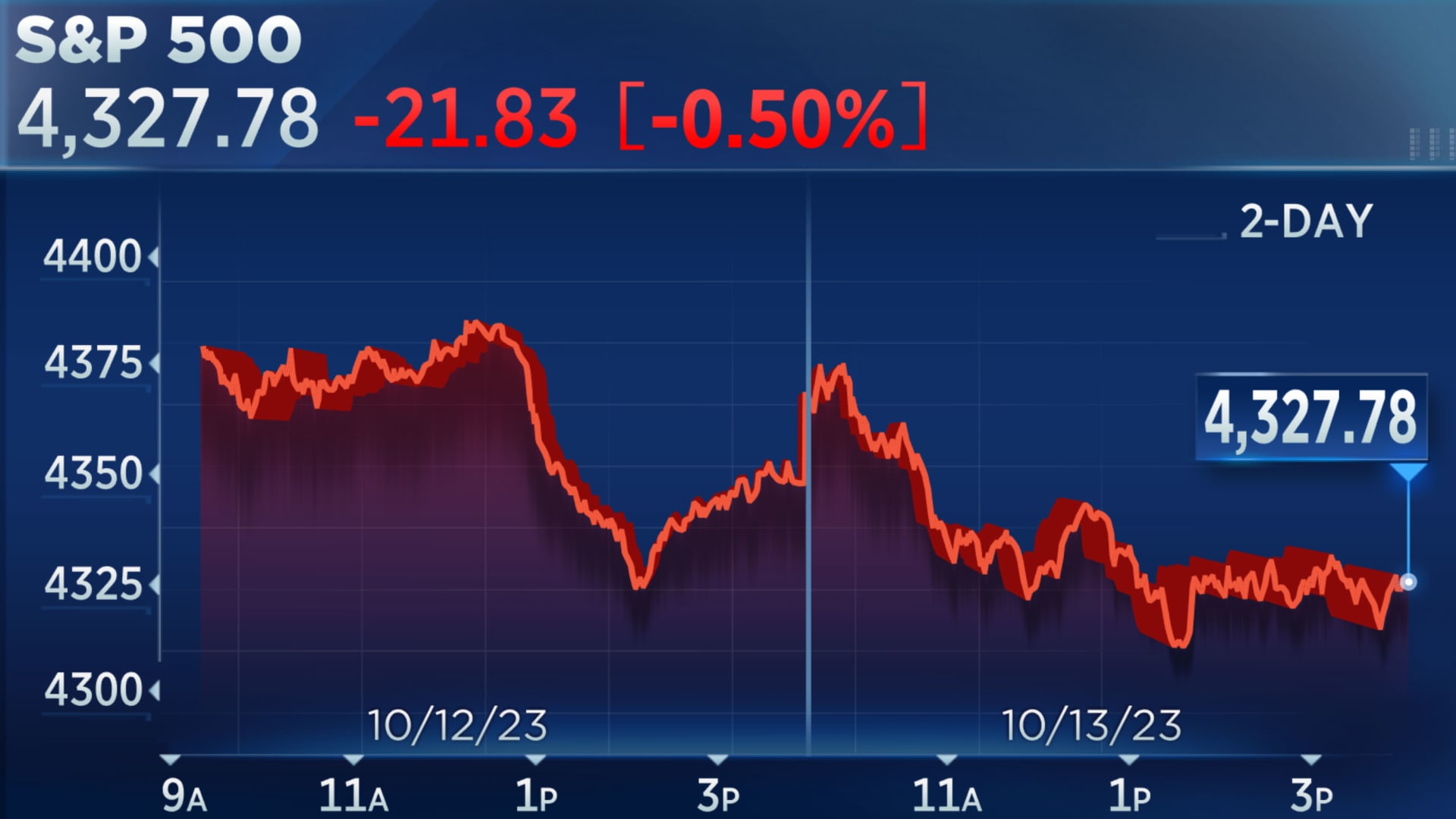

Last week, the markets had a mixed performance. The S&P 500 and Dow both saw gains, climbing 0.45% and 0.79%, respectively. However, the Nasdaq experienced a slight dip of 0.18%. Inflation remained a concern, indicating the likelihood of higher interest rates in the near future.

Geopolitical tensions added pressure to the stock market as investors sought refuge in treasury bonds.

Crude oil prices surged nearly 6% last Friday, with Brent recording its most significant weekly gain since February due to escalating Middle East conflicts and U.S. sanctions on Russian oil tanker owners.

On a positive note, major banks, including JPMorgan Chase, Wells Fargo, and Citigroup, reported robust quarterly profits that surpassed analysts' expectations, driven by higher interest rates.

Here are other key highlights from last week:

Bitcoin continued to outperform the rest of the crypto market

A steep collapse in the price of NFTs is a signal that it is maturing

Umoja Foundation fuses digital artistry with real-world impact

Polygon protocols are a destination for institutional tokenization

Here’s what to expect this week:

This week, traders and investors should keep an eye on several key economic events in the US. These include reports on Building Permits and Existing Home Sales, as well as the usual weekly data on Initial Jobless Claims. Additionally, the Philadelphia Fed Manufacturing Index will provide insights into the general business conditions in Philadelphia.

Several FOMC members, such as Harker, Barkin, Kashkari, Mester, Logan, Cook, Waller, Bostic, Williams, and Goolsbee, are scheduled to speak throughout the week, offering valuable perspectives on monetary policy. Notably, Fed Chair Powell will address the Economic Club of New York, making his remarks a critical focus for those tracking the markets.

This is a busy week for earnings. Watch out for Tesla (Nasdaq: TSLA) and Netflix (Nasdaq: NFLX) today (Wednesday 10/18/2023).

This Week’s High-Impact Global Economic Data Highlights:

China Economic News

Gross Domestic Product (GDP), Industrial Production, Retail Sales, and Unemployment

UK Economic News

Employment Change

Consumer Price Index (CPI)

This week's anticipated bias (not financial or investment advice):

Monday (10/16/23) - Red day bias

Tuesday (10/17/23) - Bullish

Wednesday (10/18/23) - Bullish

Thursday (10/19/23) - Take Profits

Friday (10/20/23) - Bearish, expect whipsaw

Trading Tip: Do not marry your bias!

Week 10/08/23 - 10/14/23 Recap

Special Tools and Strategies

This month is the ideal time to start tracking emerging crypto trends and narratives for the next bull run.

One coin to keep an eye on is Realio Network ($RIO).

RIO belongs to the category of Real World Asset (RWA) coins, which is currently a hot topic in the crypto space.

The Realio platform is described an all-encompassing, blockchain-based SaaS platform designed for the issuance, investment, and management of digital securities and crypto assets. It sets out to seamlessly integrate a fully decentralized on-chain exchange with the capabilities of an issuance and investment platform, creating a bridge between enterprise-grade blockchain technology and institutional-quality investment opportunities.

Not financial advice!

Disclaimer: This newsletter is strictly educational. The information this report provides does not constitute investment, financial, trading, or any other advice. You should not treat any of the report’s content as such. Please be careful and do your research.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/B6ZNIOAF5ZP7BG4JTJVX2A237Q.jpg)