- Rhoda Report

- Posts

- Fire in the Hole!

Fire in the Hole!

Issue #20

Hi There! The Rhoda Report has reached a significant milestone - 20 issues! I am grateful for your incredible support in reading, subscribing, and sharing with your friends and families! I truly believe that success in trading, investing, (and life) is achieved through a combination of a positive mindset, planning, and utilizing unique tools and strategies. This amalgamation gives us the edge! Cheers (raises a glass of water)!

Alright, let's dig in!

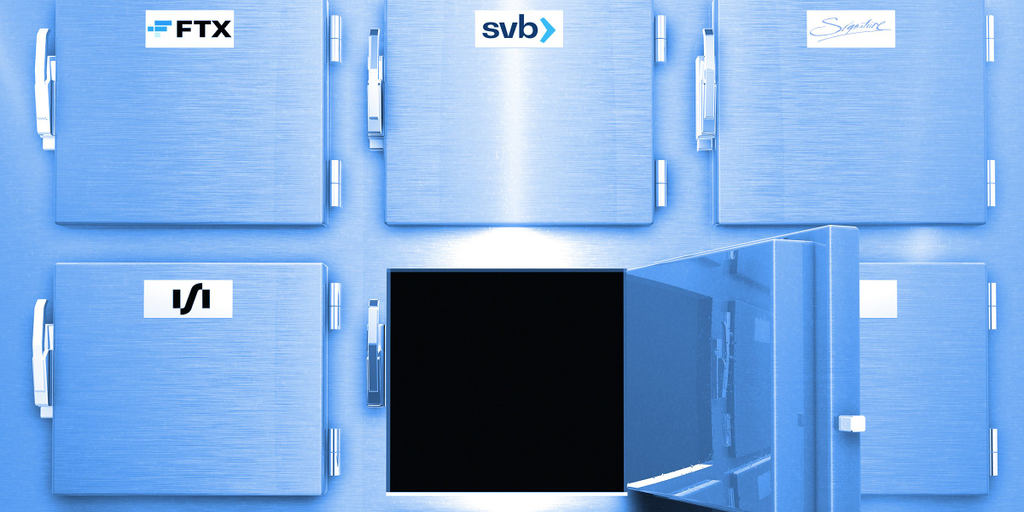

Last week was a wild ride, with more ups and downs than a roller coaster! While the Fed regulators were busy putting out fires to save failing banks, investors were trying to wrap their heads around the actual risk to the global banking sector. To add to the excitement, the CPI and PPI numbers gave investors a glimmer of hope for some inflation softening in the future.

But wait, there's more!

While all this was going on, the crypto markets showed up and showed out! Bitcoin (BTC) crushed it, smashing through $27,500 and finally breaking past the much-talked-about resistance level at $28,000 early on Sunday afternoon (3/19/2023). This was the first time since June 2022 that the price hit those levels. Ethereum (ETH) broke through the strong $1,800 level but just couldn't quite make it past that strong 20 exponential moving average (on the monthly chart).

The betting markets were also a notable highlight in the world of crypto, as traders placed bets that the Arbitrum token ($ARB) airdrop will occur on March 31.

Other key highlights from last week:

Wall Street fell over 1% as bank worries kept investors jittery

Oil tumbled to its lowest level since April 2020

UBS Group AG (UBS) agreed to purchase its rival Credit Suisse for 3 billion Swiss francs

Pundits performed a post-mortem on the crypto bank crisis

Gains Network joined Fluidity Money, a spend-to-earn DeFi protocol

Gary Vee and VeeFriends announced the launch of the "Burn Island: Eruption 2" NFT

Unstoppable Domains and Polygon Labs launched dot-polygon Web3 domains

Buckle up for an exciting and news-packed week that will undoubtedly make history!

Investors anxiously await the Fed Interest Rate Decision on Wednesday (3/22/2023). The odds of a 50-basis point hike have faded, and there is an increasing possibility that the tightening cycle may come to an end. Currently, a little over 50% of expectations point towards a 25-basis point increase. Guess we will have to wait and see.

Other key U.S. economic releases to watch include the Existing and New Home Sales, Building Permits, Durable Goods Orders, and Fed Bullard Speech.

Governments will continue to tame the contagion threatening the global banking system.

The upcoming high-impact global news includes the German ZEW Survey, the UK Inflation Rate, the Bank of England (BoE) Interest Rate Decision, and the Euro Area PMI.

Notable earnings include Foot Locker (NYSE: FL, Nike (NYSE: NKE), GameStop (NYSE: GME), Petco (NASDAQ: WOOF, Chewy (NYSE: CHWY), and General Mills (NYSE: GIS).

Next week's anticipated bias (not financial or investment advice):

Monday (03/20/23) - Protect your profits

Tuesday (03/21/23) - Bearish

Wednesday (03/22/23) - Trade with caution; sitting sideline is best

Thursday (03/23/23) - Buy lows of the day

Friday (03/24/23) - Take profits

Trading Tip: VIX is usually up during the month of March!

March Week 03/12/23 - 03/18/23 Recap

Special Tools and Strategies

Here is another useful tool that you can add to your chart analysis toolbox - the Machine Learning Technical Indicator by Justin Dehorty, TradingView's most recent Editor's Pick.

This indicator is based on Lorentzian Classification, which combines aspects of the General Theory of Relativity with a novel approximate nearest neighbours algorithm to predict the direction of future price movement.

Key features to note:

The more positive the numbers are, the more bullish the sentiment

The more negative the numbers are, the more bearish the sentiment

The intensity of the signal colour is directly correlated to the model's "confidence"

The trendline is an estimate that serves as additional confirmation of the model's predictions

Real-time trade stats are provided on each timeframe and show historical win rates

To be clear, the Machine Learning indicator is not a standalone strategy. It is recommended to use this along with other indicators or analyses. (See previous issues - #1, #4, #13, and #17 for some ideas).

Schedule a Call- Let's talk!

Wanna thank me...Buy me a coffee!

Sign up for our Monthly Trading Plan!

Join the DCG Elite Mastermind!

Disclaimer: This newsletter is strictly educational. The information provided in this report does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the report’s content as such. Please be careful and do your own research.